What Is Cash Flow (and Why It’s More Important Than Profit)

What Is Cash Flow (and Why It’s More Important Than Profit)

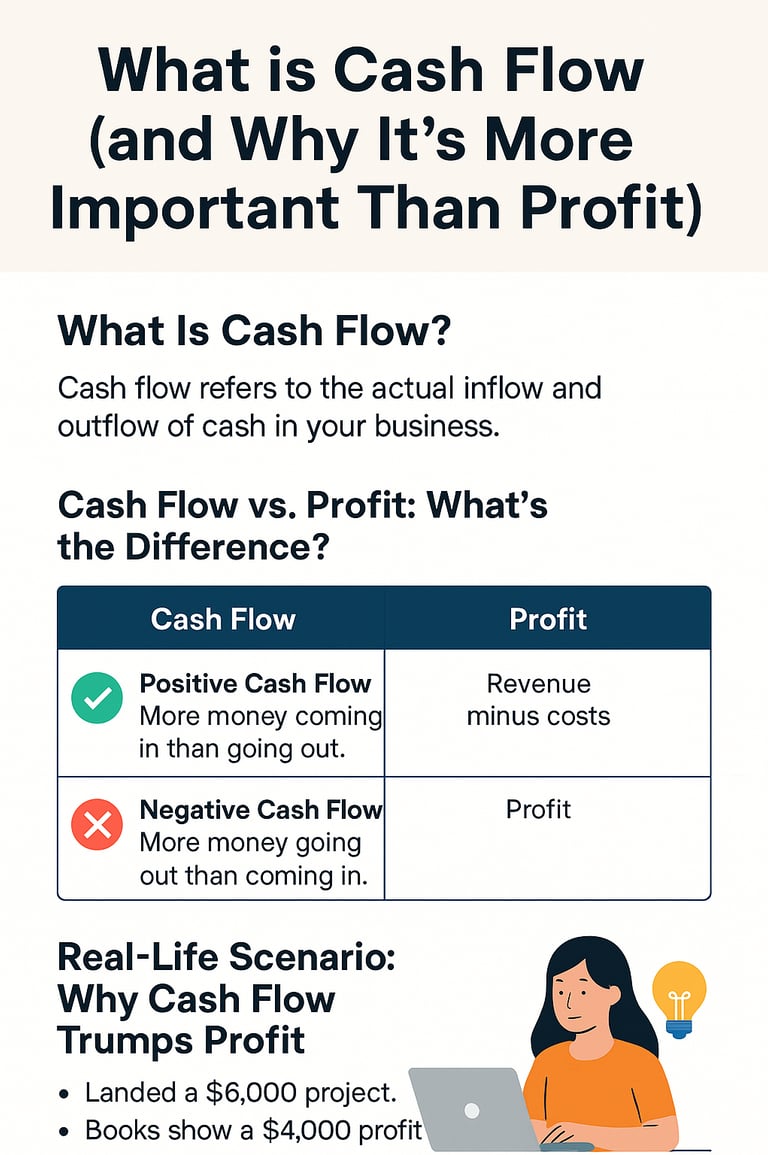

Cash flow is the actual movement of money into and out of your business during a given period. Unlike profit—which is an accounting measure that subtracts expenses (including non‑cash items) from revenue—cash flow tracks only the tangible cash you receive and spend.

Positive Cash Flow: More cash coming in than going out.

Negative Cash Flow: More cash going out than coming in.

Maintaining healthy cash flow ensures you can pay bills on time, seize growth opportunities, and build a reliable reserve for slow months.

Cash Flow vs. Profit: Key Differences

Feature Cash Flow Profit

Basis Real‑time cash Revenue minus Exp.

transactions

Includes Non No Yes

Cash Items (Depriciation, accruals)

Reflects Liquidity? Directly Indirectly

Risk of Running Low if managed High

Out of $

Measurement Cash on hand Net income

bank balances

Real‑World Scenario: Why Cash Flow Trumps Profit

Meet Sara, a freelance digital creator:

Project Booked: $8,000 website redesign

Estimated Profit: $5,000 after deducting costs

The Catch: The client pays in 90 days, but Sara’s bills are due now:

$600 monthly rent for tools & software

$1,200 subcontractor fees

$400 utilities & subscriptions

Despite showing $5,000 profit on her income statement, Sara faces a $2,200 cash shortfall this month. Without enough cash, she can’t pay her subcontractor, risking delays—and possibly her reputation.

Why Cash Flow Is Your Business Lifeline

Liquidity Management: Cash flow lets you cover rent, payroll, subscriptions, and unexpected expenses on time.

Growth & Investment: With surplus cash, you can reinvest in marketing, hire staff, or upgrade equipment—without taking on debt.

Creditworthiness: Healthy cash flow improves your chances of securing loans or vendor credit at favorable terms.

Stress Reduction: Predictable cash inflows and outflows eliminate the “feast or famine” cycle common in creative and service businesses.

5 Actionable Cash Flow Strategies

Shorten Payment Cycles: Ask clients for 30‑day or 15‑day payment terms. Offer a small early‑payment discount.

Invoice Promptly & Consistently: Automate invoicing on project completion; send reminders before due dates.

Build a Cash Reserve: Aim for 2–3 months of operating expenses in a separate savings account.

Forecast Your Cash Needs: Create a simple rolling 90‑day cash forecast in Google Sheets or accounting software.

Control Expenses: Review subscriptions quarterly; negotiate better terms with vendors; defer nonessential purchases when cash is tight.

Conclusion

Profit figures might impress on paper, but cash flow determines your business’s ability to survive and thrive. By understanding the distinction and implementing the strategies above, you’ll ensure that when opportunity knocks—or unexpected bills arrive—you have the liquidity to answer the door.